Supersize your appetite for advice on superannuation and income

It will earn you more money (even if you don't want to play lawn bowls)

Only 51% of grown ups in Australia have consulted any source of information to work out how to fund their lifestyle in the second half of their lives.

New research released today reveals only half of Australians, including around 60% of those aged 65 or older, have consulted any information about preparing for retirement or getting advice about our superannuation. I mean, what the?

This not only means most Aussies are in the dark about how much money, superannuation or government benefits they will need to rely on later in life - they are wilfully choosing not to rewire their financial knowledge to retire.

Why are we being mushrooms: do we believe we won’t get older?

I reckon there’s two big reasons we live in denial about planning for how we will fund and enjoy the second half of our life.

Money is awkward - it carries all sorts of emotional baggage, and Australia’s complex rules and expensive financial advice system are failing everyday people

Ageing is uncomfortable - all of us are ageist, even those of us getting old enough to know ageing is inevitable

The saving or “accumulation” phase of superannuation is mainly automatic for most Australians- that means our non-decisions (or defaults) can mostly achieve some sort of ‘satisfactory’ outcome.

But a little intelligent activity before we get too old for compound interest to work on our behalf will do even better.

If we want to stop working on the hamster wheel of the 38-hour week, all of us need to face the challenge of making our accumulated superannuation wealth cover our needs and wants over an uncertain number of remaining years.

We will inevitably face variable costs as we age. Think of things like health (hello cataracts or physiotherapy to ease aching joints), aged care (this won’t mean nursing homes for our generation - it will be home services to keep us living in our homes) and paying for the right type of housing as we get older (who wants to walk up 10 flights of stairs if our knees hurt?).

It’s helpful to frame your early thinking about superannuation as a means to support your critical consumption in later life.

At any age, when we review our financial management and think about what we wish we had known in the past, we should be realistic.

Accessing good-quality information about superannuation and retirement (whatever that might mean to you) actually improves your income. So do it!

Hidden costs of not thinking about it before you need it

The Association of Superannuation Funds of Australia (ASFA) are the same people that develop the ‘retirement standard’ - the ultimate guide to how much you need to save in super to have a decent retirement income once you hit 67 (the age you can claim the Age Pension in Australia).

ASFA CEO Mary Delahunty said not seeking advice “means many Australians may end up worse off than they should be in their post-working lives, simply because they haven’t been empowered with the relevant guidance.”

“This research highlights the need for urgent reform to make high-quality, low-cost advice easily accessible to every Australian worker.”

The numbers are kinda scary - especially if we want a dignified second half of life

ASFA’s recent survey — which was demographically representative of the population in terms of age, gender, education, and location — asked respondents which sources of information they consulted concerning their retirement.

Possible sources included professional service providers (like financial advisors), advice provided by super funds, information published by the superannuation industry, internet resources like online calculators, the media, and social media.

The percentage of people who had consulted each information source was:

Professional services (financial advisors) — 21%

Friends and family — 21%

Online calculators and other online resources — 15%

Advisors from super funds — 12%

Media articles — 8%

Social media — 6%

Younger Australians were more likely to have consulted informal sources like friends and family, and social media. People in the 18–34 cohort were 15 times more likely to source advice from social media than people aged 65+, leaving them far more vulnerable to scams involving superannuation.

The survey found that Australians of all ages have a high degree of trust in professional financial advisors, advice provided by super funds, and industry benchmarks like the ASFA retirement standard.

But the cost of professional advice - usually a few thousand a year (check out this article we wrote on Citro) - stops us engaging with it, learning about it or planning for it.

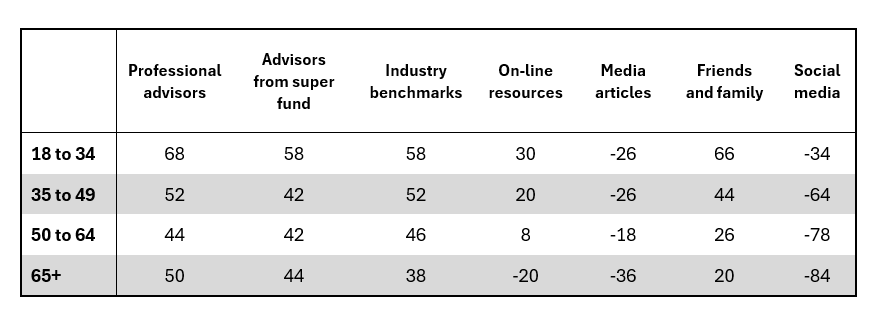

Net trust of each source (the percentage of respondents who trust the source minus the percentage of those who do not) per age cohort was as follows:

Table: Net trust (all respondents, regardless of whether they consulted an information source)

While super funds were some of the most trusted sources of advice, people don’t use them.

“Although people trust financial advisors as a source of information, the problem is that their services remain too expensive for the average working Australian to access,” Ms Delahunty said.

Most industry super funds offer free or low-cost financial advice. Call yours and ask what they can do for you.

Yes, expect your super fund to offer financial advice that will be biased towards making sure you use their pension or income products - it’s better than not seeking any advice at all.

Or not even thinking about it.

Just get started. It won’t hurt nearly as much as waiting until later on.

When I was in my 20s I went to a financial adviser. He told that it was a waste of his time to sit down with me and do a financial plan as I’ll get married and have kids and it won’t matter. A waste of his time - he repeated that several times. I left his office feeling shamed and not enough. I didn’t realise at the time that was his shame to carry - not mine!

Recently, I mentioned this experience to my aunt. She recounted a similar story.

I’m sure there are more women out there who have experienced the same. Anecdotal evidence gathered over a few decades, also tells me that at (most) times, women may receive different (read less than) advice than men.

A decade or so ago, a financial planner was recommended to me by a female colleague. My shame resurfaced at being “rejected” previously. After talking with her, she assured me the same wouldn’t happen again. She was right. I’ve received great service from the (male) financial adviser and his team (both and female) and are still with them today and planning the next stage of my life.

Maybe we (women) haven’t reached out because of prior rejection, a feeling that the service we will receive is subpar / not taken seriously (so why bother), or we don’t know how to show up (how to find a great advisor, what questions to ask and what to demand as an outcome).